- Toledo Money

- Posts

- Thankful and Thriving: Toledo’s Big Week on the National Stage

Thankful and Thriving: Toledo’s Big Week on the National Stage

A cultural powerhouse lands a Hall-of-Famer, a Toledo REIT outruns Big Tech, and 620+ readers keep showing up hungry for more.

It’s the Friday before Thanksgiving, that stretch of the calendar when the smell of turkey, stuffing, cranberry sauce, and a wave of Out-of-Office replies all start creeping into view. It’s also “Feast Week,” when every sport imaginable is on your screen: college hoops, college football, NFL, NBA… if it has a scoreboard, it’s playing.

As we head into the holiday, we’ve got a lot to be thankful for. Our recent collaboration with the Toledo Regional Chamber of Commerce was incredibly well-received, and we’re lining up a few more co-branded pieces with them to close out the year. And of course all 620+ of you. We’re genuinely grateful you’re here.

Now, onto this week’s question: just how much revenue does Thanksgiving generate? When you factor in Black Friday, sources put the total spend somewhere near the $100 billion mark. Can you believe that?

👨🏼 This Week’s Shoutout: This week’s spotlight goes to Ryan Ambrosia, owner of Ambrosia’s Automotive — the preferred independent auto-repair shop for both Costco Toledo and Discount Tire.

We appreciate your continued support of Toledo Money, Ryan; and we’re excited to see your business keep growing right here in our backyard. Looking forward to working together in the future.

Local Stock Market | 📈

Owens Corning | $OC ( ▼ 0.89% )

Dana Incorporated | $DAN ( ▼ 2.89% )

The Andersons | $ANDE ( ▼ 1.64% )

Owens Illinois | $OI ( ▲ 0.08% )

Welltower Inc. | $WELL ( ▲ 0.35% )

Marathon Petroleum Corporation | $MPC ( ▼ 3.91% )

First Solar | $FSLR ( ▼ 2.39% )

TMA IS Not Just a Gallery - It is Infrastructure

A Toledo Money Breakdown

When the American Numismatic Society (ANS), one of the worlds premier scholarly institutions dedicated to currency, medals, and the history of commerce, chooses to relocate its headquarters and priceless collection from New York City to Toledo, Ohio, that is not random.

That is a signal.

A signal that Toledo is no longer just a cheap labor logistics town pumping out Jeeps and solar panels. It is becoming something more: A city where institutions of national stature see a future, and are putting real assets behind that belief.

And the center of that gravity

The Toledo Museum of Art.

The Powerhouse We Sometimes Forget

TMA is not a cute regional museum with a gift shop and glass demonstrations. It is a three-hundred and fifty million-dollar enterprise managing pooled investments and charitable trusts totaling $352,633,413 (yes, read that number again).

Its annual operating budget is more than $24.1M in revenue, with investment income fueling more than half of operations.

Its expenses are $24M, with more than two thirds going directly into art, education, and community programming

This is a museum that invests more than most nonprofits in the region, yet remains free and open to the public.

Leadership With Corporate Muscle

This is not a garden club board.

TMA leadership includes:

Brian Chambers, Chairman and Chief Executive Officer, Owens Corning

Pat Bowe, Chief Executive Officer, The Andersons

Shankh Mitra, Chief Executive Officer, Welltower

Mike Hylant, Executive Chairman, Hylant

Joe Napoli, Chief Executive Officer, Toledo Mud Hens and Toledo Walleye

Randy Oostra, Managing Partner, Blueprint N1

Leaders representing University of Toledo, Toledo Public Schools, Huntington Bank, YWCA, Toledo Port Authority, Balance Pan Asian Grille, and major regional philanthropists

In Silicon Valley they would call this a strategic ecosystem.

Here, we just call it Tuesday.

Audience and Reach Equal Cultural Economy

Inside the walls:

107,550 gallery visitors

More than 50,000 educational and outreach engagements

Online:

5.9 million social video views, an increase of 251 percent

19.9 million total impressions, an increase of 104.9 percent

Nearly 200,000 social followers

TMA is reaching more humans than many professional sports franchises, and at a fraction of the cost.

Enter The American Numismatic Society

ANS moves from the financial capital of the world to the Glass City.

Why…

Because TMA is building world class research, preservation, and digital innovation capacity right here.

ANS brings:

$10.3M in annual revenue

~$5M in operating expenses

~$2M in payroll

~$59M in total assets

A collection of more than 800k historically significant objects (including digital currency 👀)

That means jobs, highly educated residents, research fellowships, logistics support, tourism drivers, and millions in cultural asset transfer.

And they are not moving into a strip mall, they are embedding within one of the strongest independent art museums in the country.

Why This Matters

When a major institution places a bet on a city, others notice.

This partnership:

Signals Toledo as a national hub for arts scholarship

Deepens the region’s research and cultural tourism economy

Drives new foot traffic, hotel nights, visitor spending, and national media attention

Establishes TMA as a magnet for institutional relocations rather than a consolation prize destination

Strengthens Toledo’s fight to gain talent instead of losing it

Other cities trade museums like superstar free agents

Toledo just signed a Hall of Famer

The Toledo Money Take

This is not about coins.

It is about confidence.

Confidence that Toledo’s future economy will never be defined only by truckloads and manufacturing lines, but by ideas, creativity, and community infrastructure that attract talent and capital.

The arrival of ANS in Toledo, and specifically into the orbit of TMA, is one of the most strategically meaningful cultural wins in our region in decades.

Now imagine if this is only the first phone call TMA answers.

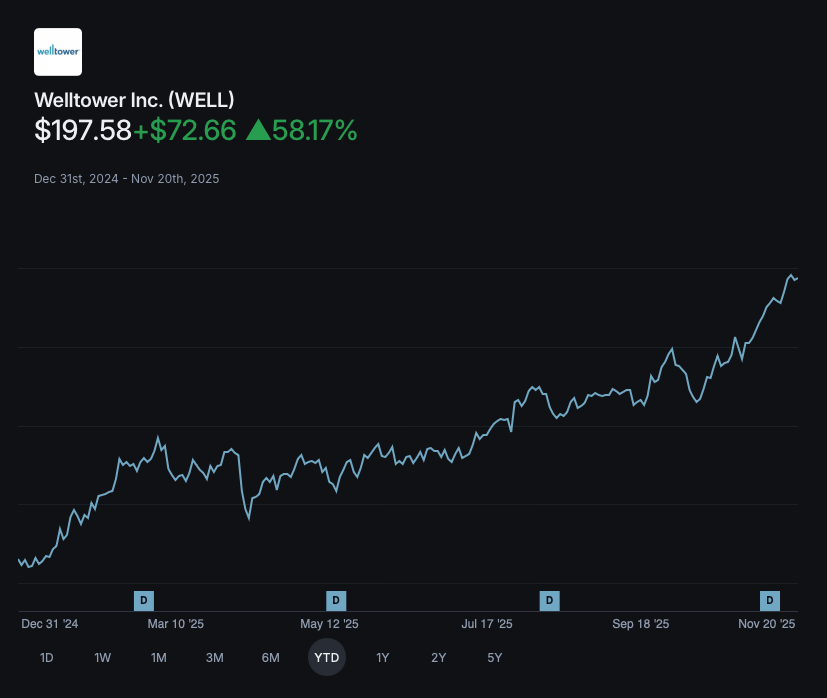

Quarterly Earnings | WellTower Outpaces Tech Giants YTD

Toledo’s king of the silver-economy real-estate move is outpacing Big Tech and rewriting the playbook.

WellTower (NYSE: $WELL ( ▲ 0.35% )), headquartered in Toledo, just posted a third-quarter showing that most REITs can only dream about. And if you think REITs are boring, you haven’t looked at this one.

The Headlines

Same-store NOI grew 14.5% YoY, and seniors housing operations soared 20.3% YoY.

Normalized FFO per share reached $1.34, up 20.7% YoY.

And the stock? Up approximately 59.5% YTD (including dividend reinvestment); far outpacing many big-tech names.

Big Picture: Why This Matters

When a company headquartered in Toledo delivers that kind of performance and the share price runs ahead of giants in tech, it means three things:

Demographics are the new technology. The aging-population trend is real, and WellTower isn’t waiting on it; it’s building the scaffolding.

Operational excellence meets actionable strategy. Strong same-store performance + targeted capital allocation = the formula for outperformance.

Toledo is playing at the global table. When your REIT is outperforming meta/amazon/nvidia-type trajectories (even if not identical in business model), your region gets spotlighted.

For Local Executives & Investors

It’s not just about a rising stock for your retirement portfolio. It’s about corporate identity: a major public company headquartered here, leading its segment.

For talent and real-estate markets in northwest Ohio: when a local company is this capital-rich and this visible, it creates magnetism.

For portfolio benchmarking: If your Iowa manufacturing firm or family-owned services business isn’t outpacing your local cost of capital this well, you might not be building the durable enterprise you think.

The Takeaway

Welltower’s latest quarter isn’t just good — it’s exceptional for a REIT. And when you pair that with a nearly 60% YTD stock run, you’re looking at a company that’s not only capitalizing on trends… it’s defining them.

For Toledo, that means we’re no longer just the low-cost location or hidden gem. We’re home to a publicly traded powerhouse with global reach and local roots.

💼 The Advisor’s Desk

Welcome to The Advisor’s Desk, where the professionals of Northwest Ohio pull up a chair and share their best kept secrets; the kind that save you money, protect your business, and make you sound like the smartest person in the room. Each week, we tap into local expertise, from tax advisors and attorneys to commercial real estate pros and insurance veterans, to bring you practical tips that matter.

Do not worry, The Money Confessional will be back soon to spill the beans. For now, consider this your weekly dose of free consulting without the billable hours.

Thinking about selling your business? Start sooner than you think…

This week’s expert: A seasoned M&A advisor who’s seen more deals made, delayed, and downright derailed.

Here’s a secret that surprises most founders:

The sale of your company doesn’t happen during negotiations; it happens years before anyone signs an NDA.

Buyers don’t purchase your hustle. They purchase transferable value. And that value needs to be de-risked, documented, and ready to operate even if you suddenly disappear to Hilton Head.

If you want top dollar when buyers come knocking, here’s where to focus:

1. Normalize Your Financials

Clean books win confidence. Eliminate personal expenses, one-time anomalies, and “creative accounting.” Buyers want to trust the EBITDA, not decode it.

2. Systematize Your Success

If your business operates only because you operate… you don’t own a company, you own a job. Document processes, diversify customers, and make revenue repeatable.

3. Lock Down Key Talent

Retention agreements, strong culture, and clear roles reduce buyer risk. A business that loses its top employees in a sale isn’t a business, it’s a gamble.

4. Strengthen Your Moat

What keeps competitors from stealing your lunch? Intellectual property, contracts, exclusive suppliers, data, brand loyalty, build barriers that last.

5. Plan Your Exit Tax Strategy Early

Waiting until after a LOI is like deciding to diet after Thanksgiving dinner. Structure matters; whether you sell assets, equity, or merge into a larger organization.

Local Angle

Northwest Ohio isn’t just producing businesses… it’s producing buyable ones.

Manufacturers are implementing automation to boost margins, logistics companies are diversifying client pipelines, healthcare service groups are consolidating, and even family-owned shops are turning into attractive acquisition targets. Investment firms and strategic buyers are watching — quietly.

Because the next big Toledo success story might not be a startup.

It might be the business that’s been profitable here for 30 years…

and finally ready to cash in.

💵 Money Snacks

Here are a few headlines we are snacking on

One of our regular intel sources dropped something interesting this week: that long-abandoned Rite Aid sitting at the Route 64 intersection in Waterville, next to Fifth Third, the YMCA, and a Mercy Health building…it finally has a new tenant. And for anyone in Monclova, Whitehouse, or Waterville who’s been wondering what’s going in there?… the wait is over. It’s not exactly headline-grabbing news, but it is movement: Dollar Tree is taking over the former Rite Aid space. Development is development, but we’ll let you decide how excited to be about this one.

Crypto just erased a year of gains in six weeks. Bitcoin’s surge past $100K late last year has officially unraveled. The crypto market has shed $1T+ since October, pulling bitcoin back below $90,000 and into bear-market territory with a 26% drop from last month’s peak. What’s behind the slide?

AI bubble worries: Investors are pulling back from riskier assets as valuations on AI names stretch thin.

Tariff uncertainty: Even with a temporary US–China “trade truce,” tariff threats continue to shake markets. The Oct. 10 news alone wiped out nearly $19B in liquidations.

Crypto isn’t crashing it’s resetting. But the momentum that carried it through 2024 is gone, at least for now. What are your thoughts? we’d love to hear them.

Toledo just landed a big one. The Electric Vehicle Innovation Summit, an event that’s pulled crowds in Abu Dhabi for the last five years, is making its U.S. debut at the Glass City Center next November (Nov. 3–5). Roughly 2,000 attendees are expected, with a 70/30 split between domestic and international visitors. (Keep an eye on Grande Aire… the private jets might get interesting.) The summit is run by Leading Events USA, a group that builds industry-growing B2B events. And honestly, hosting it here checks out, Toledo sits right on one of the country’s automotive arteries. As for the economic impact? Think hotels packed (Hilton Garden Inn, Renaissance), restaurants buzzing, and downtown getting a solid bump. We’ll keep tracking this as details roll out.

📬️ Forward Thinking

We’re not just building a newsletter—we’re building a clubhouse for ambitious professionals who care about Toledo’s economic future (and their own place in it).

If you know a colleague, peer, or friend who should be part of this circle, pass this along. The more sharp minds we bring to the table, the stronger our region grows.